Strategy

Disciplined Investment Focus

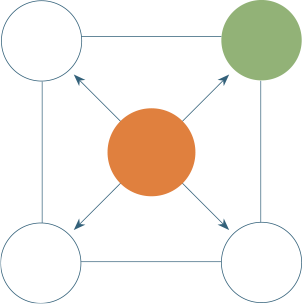

Domain Timber employs a well-defined timberland investment strategy. Our strategy is focused on the acquisition, management and disposition of properties located in the major timber regions of the United States which typically meet a certain set of criteria, including:

- Smaller, non-contiguous properties, generally within the 2,000 to 30,000 acre size range

- Significant biological growth and income potential

- Diversified by geography, botanical species and age to reduce risk and enhance liquidity

- Potential for value creation from an active, opportunistic and sustainable management regime

- Investments in markets with strong or growing demand and micro-market conditions

Acquisitions

We believe our detailed modeling and valuation processes are proven and time tested. Domain Timber uses its network to source opportunistic deals and then applies a modern portfolio theory investment style, designed to reduce risk, enhance returns and create a well-diversified portfolio for our investors.

Land Management

Land management is primarily focused on silvicultural practices to maximize growth rates and compound returns from asset class movements. Timber sales strive to capture periods of relative pricing strength in the local sub-markets. In addition, our regional foresters evaluate each parcel for value-added opportunities, such as road and bridge construction, easements, maple taps, and hunting leases that further enhance the overall value.

Dispositions

Domain Timber identifies one or more exit strategies for each parcel at acquisition, adjusts strategies as conditions require, and manages the properties accordingly with the aim to capture highest and best use. The management plan focuses on creating the most desirable property for the target market at disposition. Commencing property enhancement projects early in the holding period allows sufficient time for the implementation of the full plan prior to disposition, allowing our investors to obtain the most value out of the investment.

Forest Stewardship

Sustainable forestry entails the management of forests to meet the needs of the present, without compromising future generations. At Domain Timber, we thoroughly understand and strongly support the idea that we must manage our forestland investments in such a way as to balance our investors’ financial goals with the need and desire to preserve our forestlands for future generations.