Structured Debt, Private Equity and Credit

Domain provides private credit to operating companies and also lends against asset portfolios. Investments seek to exploit opportunities in esoteric asset classes and unique situations, driven by our capability to consider all the factors in determining risk and potential. Domain focuses on pricing methodologies and structural creativity to generate risk-adjusted returns.

We source a wide range of opportunities that meet different investors’ needs while specializing in asset-backed structures that preserve capital through a rigorous approach to underwriting. Domain also has a reputation for providing flexibility in structuring investments, assessing each opportunity on its individual merits and working to provide a specialized solution for each investment that maintains capital preservation as a primary priority.

With risk mitigating structures in mind and an eye for investments, Domain strives to generate yields for its investors that are commensurate with both the strategy and the individual needs of each investor.

Partnerships that perform.

That’s our domain.

With access to a variety of private investments, we strive to meet the needs of investors interested in off-market transactions and provide alternative opportunities for diversity within their portfolio.

Domain evaluates each opportunity individually, with an emphasis on instruments that can generate attractive current yields and provide stability due to their long-term intrinsic value. Starting with thorough collateral valuation, Domain assesses the credit to ensure returns are appropriate and that capital is protected. The result is a selection of financial instruments that can potentially provide for downside protection with an appropriate risk adjusted return.

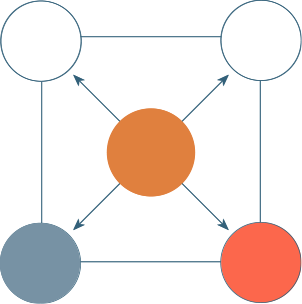

As a multi-disciplined firm, Domain believes it is in a strong position to provide insight and a multitude of experience in applying structured debt and equity to achieve diversification and allocation goals.

Structured debt, with Domain’s eye toward underlying asset value, can provide diversity in terms of structure, yield, maturity and collateral type. This can help to achieve a range of desired outcomes unrelated to standard benchmarks due to its low correlation to other fixed income sectors.

With the consolidation and realignment in the equity market over the last decade as well as intervention in interest rates, we believe the private markets have been a source of better risk adjusted returns and, as a result, these markets have grown in recent years and opportunities are plentiful.

At Domain, our investment knowledge allows us to maintain rigorous methodologies to fulfill our fiduciary responsibilities. We deploy our innovative operational capabilities to fully support our team in serving our clients.

The investment process begins with listening to and fully understanding the client’s investment objectives. This allows us to develop a strategy that meets each client’s needs. We then provide comprehensive and customizable services throughout the investment lifecycle. We strive to anticipate issues and enact solutions that benefit our client.

Our deep knowledge and expertise coupled with extensive analytical analysis, allows us to identify key performance drivers and risk factors at every stage of an investment cycle.

Adding credit instruments to a well-diversified portfolio can serve to generate predictable and relatively stable cash flow, manage downside risk, and provide potential for sizable upside. This asset class is opportunistic and flexible, with instruments and structures that meet any investors’ needs in regards to returns, term, correlation, and other factors.