Feature Films, Television, Digital Media, Literary Works, Recorded Music, Theatrical Productions, Venture Capital

Domain has extensive experience in diverse alternative investment opportunities, including origination and execution of strategies within media, entertainment, and technology focused companies.

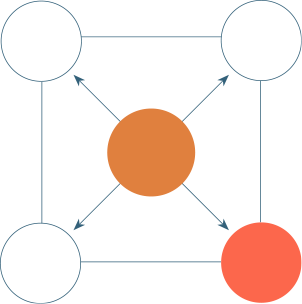

To meet the particular investment requirements of each client, we identify potential opportunities and deliver a fully integrated investment approach, including due diligence, transaction structuring, contractual negotiations, and asset supervision throughout an investment’s lifecycle.

With specialized experience in a broad array of asset classes, we believe we have a competitive edge throughout the investment process, from deal sourcing and resource management to disposition.

Domain’s investment services are guided by long-term, meaningful partnerships — being responsive and collaborative with each investor to achieve their objectives in terms of targeted returns, duration, correlation, and other factors.

Leveraging strong relationships, Domain has made many investments within these sectors, including acquisitions of media and entertainment portfolios that are predominantly intended to deliver cash-on-cash returns and a low correlation to the broader market. Growth and late-stage venture capital investments in companies are structured to provide the potential for outsized gains while still protecting invested capital.

This advantage can benefit our clients most often in terms of asset diversification, as well as providing the opportunity to invest with confidence into assets that might otherwise be overlooked.

Partnerships that perform.

That’s our domain.

Domain’s underwriting discipline and attention to detail is driven by a full and unbiased view of the opportunity that appropriately supports our performance expectations.

Over the past decade, a digital revolution has transformed the media and entertainment industry, creating compelling investment opportunities. With rapid growth in the amount of content, new distribution channels, and innovative business models, investors are seeking specialized knowledge and an experienced perspective in order to take advantage of these opportunities.

With Domain’s access to deal flow and our carefully curated relationships, we focus on a diversified asset-based approach, investing in catalogs and portfolios that generate an appropriate yield while striving to maintain the security of our investor’s capital.

Domain’s media and entertainment portfolio includes, but is not limited to, film, television, and other content participations and co-investments.

Over the last 20+ years, the technology industry has experienced an unprecedented expansion that has created disruption, and corresponding opportunities. Led by the invention of the Internet, and accelerated by the rapid advancement and proliferation of computing power, speed, cloud storage, machine learning, and mobile technologies, virtually every business and consumer has been impacted.

Many of these technology companies, along with those now leveraging the new tech capabilities, are seeking growth and late-stage venture capital as they choose to stay private longer. This new dynamic is shifting much of the historical IPO gains to those late stage private investors that have access to these opportunities.

At Domain, our investment knowledge allows us to maintain rigorous methodologies to fulfill our fiduciary responsibilities. We deploy our operational capabilities to fully support our team in serving our clients.

The investment process begins with listening to and fully understanding the client’s investment objectives. This allows us to develop a strategy that meets each client’s needs. We then provide comprehensive and customizable services throughout the investment lifecycle. We strive to anticipate issues and enact solutions that benefit our client.

Our deep knowledge coupled with extensive analytical analysis, allows us to identify key performance drivers and risk factors at every stage of an investment cycle.

Adding media, entertainment, and technology investments to a well-diversified portfolio can provide sizable upside potential and/or lower correlation to the broader investment markets. These asset classes are opportunistic and flexible, with instruments and structures that can meet a wide array of investor requirements.