Building Value Through Discipline, Insight & Trust

Total Assets Under Management:

$8.3B

Capital Deployed Since Inception:

$12.2B

Current Number of Investment Vehicles:

71

Since 2008, Domain Capital Group has partnered with leading institutions to design and manage specialized investment strategies. We combine disciplined risk management with innovative thinking, building trusted relationships that create resilient portfolios and long-term value.

Total Assets Under Management

Domain serves institutional investors, pensions, sovereign wealth funds, family offices, and wealth platforms—seeking differentiated access to alternative markets. Our integrated platform combines deep sector expertise with in-house legal, compliance, and operational capabilities that support transparent, aligned, and high-touch partnerships.

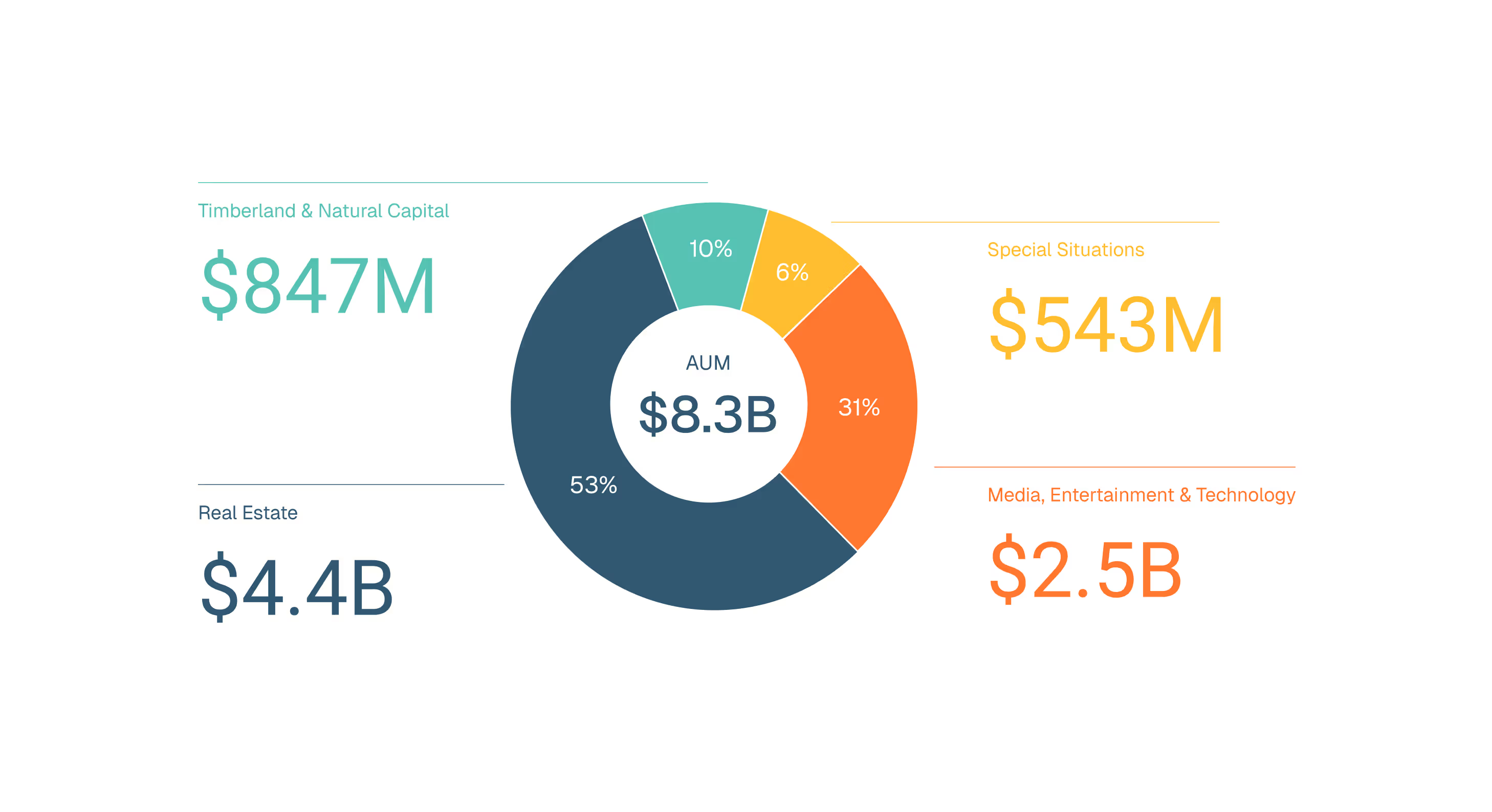

As of September 30, 2025, Domain managed approximately $8.3 billion in total assets through its two registered subsidiaries, Domain Capital Advisors, LLC and Domain Timber Advisors, LLC. The assets are comprised of approximately $7.3 billion in real estate, debt, alternative, and other assets constituting Regulatory Assets Under Management (“RAUM”) and approximately $1.0 billion in non-RAUM which includes real properties and additional loans serviced.

Our Core Investment Verticals

Domain’s real estate focus since inception has been leveraging its decades-long experience managing a large multifamily platform with a national footprint and over 40,000 units. Domain also delivers differing risk-adjusted returns by investing throughout the capital stack in other property types with substantial exposure to hospitality, and others such as student housing, senior housing, and mixed-use.

Our thoughtfully constructed portfolios in our commingled funds include film libraries, television participations, recording and publishing music rights, and select new production investments. This vertical also makes equity and debt investments in sports, theater, technology platforms, and other content-supportive opportunities. The combination of these sectors offers uncorrelated returns with intrinsic long-term value.

Domain's Timberland & Natural Capital team specializes in managing timberland and natural capital assets across the United States. With a mandate to drive change, the team employs active strategies to unlock alpha in ways that traditional owners and managers have often overlooked or deprioritized. Our approach combines disciplined forestry management, innovative land-use opportunities, and market-driven value enhancements to generate sustainable returns while promoting environmental stewardship.

Our special situations investments are often purpose-driven with a return goal that stands alone. The vertical applies broad knowledge and expertise to niche asset-backed loans, restructurings, turnarounds, emerging managers, and other investment situations to meet investors' needs. Through disciplined underwriting and active management, performance is closely monitored from entry to exit to ensure stability.

.avif)

.avif)